Save to give: Stretching your charitable dollars

Nov 02, 2017

*This is the second installment in the save-to-give series. Read part one, “Planning for your philanthropy retirement” or part three “How millennials will shape philanthropy.”

The first blog, in this three-part series, discusses the advantages of using a donor-advised fund (DAF) and the save-to-give mindset to maximize your ‘philanthropy retirement’ was presented. Real data was used from the past 20 years to demonstrate how a donor, who opened an account with Vanguard Charitable in 1997, could have extended the duration of her giving from 10 to 20 years while increasing total impact by 56%, providing her favorite charities with consistent, ongoing support.

This blog will utilize the same investment performance data from the past 20 years to look at a new scenario.

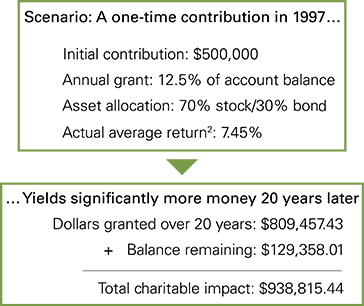

Let’s again assume the year is 1997. Consider Anthony, a grateful cancer survivor who wants to donate to support further research at the hospital where he received treatment. Anthony has $500,000 in charitable assets at his disposal. He knows efforts to cure cancer will be ongoing, and he wants to continue to play a role in the coming years. If he uses his current funds to make a one-time, lump-sum gift, he worries he will not be able to offer more support down the line as researchers continue to make progress. He opts instead to deposit the $500,000 into a Vanguard Charitable donor-advised fund account where it will grow tax-free over time. After assessing his risk tolerance, he chooses an asset allocation of 70% stocks and 30% bonds. Lastly, Anthony wants to get started right away with his gifts to the hospital, so he structures his account to recommend automatic recurring grants amounting to 12.5% of his balance at the end of each year.

How does Anthony’s strategic investment in philanthropy pay off? Let’s fast forward to 2017, using the real-life data for the intervening years to find out.1

The results indicate that by saving to give, Anthony has made a substantially larger impact, and, perhaps most important, continues to have the means to further support cancer research for the foreseeable future. Through his annual grants over 20 years (each averaging about $40,500), he has donated $809,457.43 to cancer research, significantly more than if he had made the direct contribution of $500,000 to the hospital in 1997. Moreover, he still retains $129,358.01 in his charitable account.3

Anthony can continue to enjoy tax-free growth on this remaining balance while making his same annual grants. He can also consider legacy options for his account, such as leaving it to his children, or establishing an Endowed Grant Plan (EGP), which will continue his yearly grants to the hospital even after his passing. Overall, at the 20-year mark, Anthony has nearly doubled his charitable giving capacity, increasing his impact by 88%.

| Through Anthony’s annual grants over 20 years (each averaging about $40,500), he has donated over $800,000 to cancer research, significantly more than if he had made the direct contribution of $500,000 to the hospital in 1997. |

There is more to this scenario than just the monetary benefits. Through his annual giving, Anthony can establish an ongoing relationship with the hospital, whereby he is more likely to be closely involved with the research. The hospital may provide him with regular updates, the opportunity to direct his annual grants to specific initiatives, and more.

His DAF account also provides him with the flexibility to alter his giving to support a major fundraising campaign, or to increase his annual gifts if there is an economic downturn and the hospital finds that other revenue streams have gone dry. In short, Anthony’s decision to save to give has empowered him to be more strategic, thoughtful, and impactful with his giving.

To read the first blog in the series, click here. To read the third blog, click here.

1In this scenario, the following assumptions were made:

- All investments are subject to risk. Past performance does not guarantee future returns. Diversification does not ensure growth or protect against a loss in a declining market.

- All contributions are made as charitable donations to a philanthropic account held at Vanguard Charitable’s donor-advised fund. No startup costs are incurred, but accounts are charged an annual administrative fee based on balance: 0.60% for the first $500,000 and 0.40% for the remaining balance. Pricing will continue to decrease as account balance increases.

- All account assets are invested in a mix of underlying Vanguard® mutual funds, which assess an expense ratio. Expense ratios are assessed by the underlying funds and may vary based on account allocation and status; Vanguard Charitable does not itself charge investment fees.

- Many donors contribute to a DAF at year-end and then start recommending grants in the following year. To represent a standard accrual time in the scenarios, contributions are counted on January 1 and grants are issued on December 31 of the respective year.

- Invested assets are rebalanced monthly to match recommended allocations. The allocations in the paper are suggestions, and donors are encouraged to diversify their investment recommendations to take advantage of a broad range of investment options, including international and domestic and across major asset classes.

2Actual average return is calculated as a time-weighted return annualized over a 20-year period.

3Net performance is based on actual returns of the Investor share class of Vanguard Total Stock Market Index and Vanguard Total Bond Market Index Funds from January 1997 through December 2016. Performance returns reflect market movement, reinvestment of dividends/interest and capital gains, and deduction of the underlying fund’s expenses. Vanguard Total Stock Market Index Fund benchmark: Spliced Total Stock Market Index reflects the performance of the Dow Jones U.S. Total Stock Market Index (formerly known as the Dow Jones Wilshire 5000 Index) through April 22, 2005; MSCI US Broad Market Index through June 2, 2013; and CRSP US Total Market Index thereafter.

Vanguard Total Bond Market Index Fund benchmark: Spliced Barclays U.S. Aggregate Float Adjusted Index reflects the performance of the Barclays U.S. Aggregate Bond Index through December 31, 2009, and Barclays U.S. Aggregate Float Adjusted Index thereafter.