Once a donor opens an account and contributes charitable assets, those assets can only be used for charitable purposes. The contributions are invested with the potential to grow over time, which can lead to larger, recurring donations.

If you are a representative of a nonprofit organization and have a question for Vanguard Charitable, please email grants@vanguardcharitable.org. In your message, include your organization's name and Employer Identification Number (EIN) so that our team can provide direct support.

What's new with Grant Payments?

Vanguard Charitable is now issuing Grant Payments with PayPal. This service allows you to receive your funds in a matter of minutes. Get started by going to paypal.com/charities to sign up. If you already have a PayPal charity account that has confirmed charity status, log in and ensure your information is updated to avoid delays in receiving grant payments. For additional support, visit paypal.com/us/smarthelp/contact-us, or watch the videos below.

Learn more about Grant Payments with PayPal

How to properly secure your Grant Payments account

"Our Caltech Gift Processing team is delighted with Vanguard Charitable’s recent utilization of Grant Payments with PayPal. This shift has not only simplified the receipt of funds but also streamlined the tracking of donor contributions online. This modern approach surpasses the traditional method of receiving checks.” -California Institute of Technology (Caltech) representative

How can we help?

- My nonprofit just received a grant or information request from Vanguard Charitable. What do I do next?

- I’d like to know more about Vanguard Charitable and donor-advised funds.

- I’m looking for resources that could be helpful to my nonprofit organization.

- I’m a donor who wants to find a charity to support.

- I’m a nonprofit interested in funding from Vanguard Charitable’s mission funds.

My nonprofit organization just received a grant or information request from Vanguard Charitable. What do I do next?

Many nonprofit organizations become aware of Vanguard Charitable when they receive a grant recommended by one of our donors. We’ve issued grants to more than 100,000 nonprofits since our founding. Upon receiving a grant, you are welcome to access the funds and utilize them to further your mission. Check the grant details for any additional guidelines.

Here are some other steps you may want to take:

- Use the grant to familiarize your staff with DAF grants and relevant IRS rules: For example, you should not send a tax receipt to DAF donors, as they’ve already received one from their DAF provider (e.g., Vanguard Charitable). For more nuanced rules, see our

- Continue to promote your ability to accept grants from DAFs: Consider mentioning DAFs on your website, in fundraising efforts, and on promotional materials.

- When able, thank DAF donors and remind them of monthly or recurring grant features offered by most DAF providers.

Why is Vanguard Charitable asking for information from my organization?

Why is Vanguard Charitable asking for information from my organization?

To process a grant recommendation submitted by a donor, we may need to request certain information from you to verify your charitable status. Our goal is to get the funds to you as soon as possible. We’ll keep your information securely on file so donors can more easily recommend grants to you in the future.

Potential information needed from your organization:

- Contact information

- Employer identification number (EIN)

- Legal charity name

- Mailing address

- Mission statement

Religious, government or supporting organizations may require additional information. Learn more about our due diligence process.

Why is a Candid profile so important?

Why is a Candid profile so important?

We strongly recommend updating your Candid profile as it is often the first place our donors look before recommending a grant. Earn a Bronze, Silver, Gold or Platinum Seal of Transparency on Candid, then renew each year. This ensures that our donors have up-to-date information about your organization and offers an extra layer of trust. (View our own profile on Candid for an example.)

Note: Make sure your NTEE codes are accurate when completing your profile.

How did your donors learn about my organization?

How did your donors learn about my organization?

Our donors generally learn about nonprofits through recommendations from friends and family, research, or an existing relationship with your organization. We also offer databases and tools, such as Candid’s Nonprofit Directory or the Nonprofit Aid VisualizerTM (NAVi), to help our donors search for charities.

To whom do I send the tax receipt?

To whom do I send the tax receipt?

In the case of donor-advised fund grants, no one. You shouldn’t send the tax receipt to the donor, because they’ve already received one from us when they made their initial contribution. You do not need to send us a tax receipt, either.

How can I thank the donor who recommended the grant?

How can I thank the donor who recommended the grant?

We understand that thanking donors for supporting your organization may be a vital part of your outreach. When donor contact information is provided, you may thank them, as long as acknowledgment of the gift goes to Vanguard Charitable and a tax receipt is not issued.

Sometimes our donors decide to give without recognition. The grant details contain all the information a donor has elected to share. If a donor has chosen to give anonymously or only share the fund name, it indicates that they do not wish to receive an acknowledgment for that specific grant. We respect our donors' recognition preferences and will not release unauthorized information.

How long does it take for a grant to arrive?

How long does it take for a grant to arrive?

Grants are generally processed within a few days. Delays may arise if we require additional information from your organization, so please respond promptly if contacted by our Grants team.

“Once you start getting into philanthropy and you get that satisfaction in making the world a better place, I just don't see how you can stop.” – Vanguard Charitable donor

I’d like to know more about Vanguard Charitable and donor-advised funds.

Who is Vanguard Charitable?

Who is Vanguard Charitable?

Vanguard Charitable (EIN: 23-2888152) is a leading 501(c)(3) nonprofit organization whose mission is to increase philanthropy and maximize its impact over time. We do this by sponsoring donor-advised funds (DAFs).

What are donor-advised funds (DAFs)?

What are donor-advised funds (DAFs)?

DAFs are tax-effective charitable giving accounts for individuals that are designed exclusively to invest, grow, and distribute funds to charities for meaningful and lasting impact.

How does giving through a DAF benefit nonprofits?

Donor-advised funds pull more dollars into the philanthropic sector by investing charitable assets for growth, making non-cash assets available for donation, and encouraging donors to be more strategic and thoughtful with their giving.

Less paperwork, greater impact

Our grant minimum is $500. Our average grant is $10,000.

Long-term Giving

Donors create ongoing granting schedules, providing stability for nonprofits.

Liquidated Assets

We liquidate securities, mutual funds, and complex assets that turn into grants.

Generational Generosity

Donors can create succession plans to ensure grants for many generations.

Matching gifts

We allow companies to match donor gifts.

Ask a donor: How do you choose which charities to support?

“When you see their passion and dedication…that’s the first step in determining that they're a good organization” – Vanguard Charitable donor

Is my organization eligible to receive a grant from Vanguard Charitable or another DAF provider?

Is my organization eligible to receive a grant from Vanguard Charitable or another DAF provider?

Donors can recommend a grant to any 501(c)(3) public charity in the U.S.

Can I apply for a grant from a DAF sponsoring organization like Vanguard Charitable?

Can I apply for a grant from a DAF sponsoring organization like Vanguard Charitable?

No. Grants that come from DAFs are recommended by individual donors. Promoting your ability to accept DAF grants to your existing donor base is a great way to boost the number of grants you receive. Updating your GuideStar profile is also an excellent step you can take to be seen by more donors with DAFs.

Why do donors give with a DAF?

Why do donors give with a DAF?

A DAF donor (also called an “advisor”) may be a retiree who opened a DAF so that they could continue giving after they stopped working. Or, a DAF advisor may have found a private foundation to be too costly and burdensome, and opted for a lower-cost giving tool with more flexibility. Many DAFs are advised by families who have pooled their charitable resources and view philanthropy as a communal endeavor.

Individuals use DAFs for a variety of reasons, but the common thread is a desire to further one’s philanthropic efforts. Some of the advantages of a Vanguard Charitable DAF are:

1. Convenience:

Instead of having to personally track all their giving, donors can use DAFs as a centralized hub to simplify their philanthropy. One contribution can fund multiple donations to a donor’s favorite charities.

2. Increased giving potential:

Assets in a DAF are invested tax-free, enabling many donors to grant much more to charity over time.

3. Flexibility:

In the wake of a crisis or economic downturn, donors with DAFs can respond quickly. Charitable resources in a DAF are “primed” and ready for rapid disbursal.

4. New charitable assets:

Vanguard Charitable can accept donations of non-cash assets such as appreciated securities, private equity, real estate, and more. These complex donations pull additional resources into the philanthropic community.

How do donors recommend grants?

How do donors recommend grants?

- Donors can recommend a grant to any 501(c)(3) public charity in the U.S.

- Vanguard Charitable does not accept grant requests directly from charities.

- Donors choose the grant amount, with a minimum of $500.

- Our average grant is approximately $10,000.

- Donors select how they want to be recognized and choose to identify themselves or remain anonymous.

- Only 4% of grants are completely anonymous.

- Donors recommend the timing. They can send the grant funds immediately, in the future, or on a recurring basis.

- We complete due diligence to verify the nonprofit’s charitable status and determine whether the gift preserves the charitable intention of the donor. If so, we issue the grant.

What is Vanguard Charitable’s due diligence process?

What is Vanguard Charitable’s due diligence process?

We examine a recipient charity's tax-exempt status, the intended use of the grant, and any potential impermissible benefits. Our dedicated grants team follows a strict protocol to get the funds to you as smoothly as possible while still adhering to IRS guidelines. Learn more about our process here.

I’m looking for resources that could be helpful to my nonprofit organization.

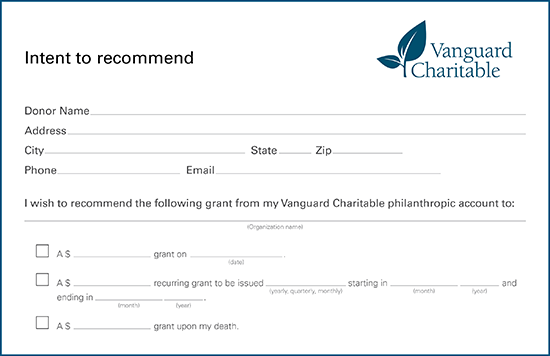

Pledge card alternative

Instead of using a pledge card, we provide nonprofits with an "Intent to recommend" card. Use our card the same way you use a pledge card -- to boost giving, assist with your nonprofit's long-term financial plans and support existing and new donor relationships. The difference between the two is that our "Intent to recommend" card is not a legally binding pledge. Pledges can't legally be fulfilled by a donor-advised fund grant. However, donors can use our card to indicate an intent to recommend a grant.

Does your organization already have a pledge card? Contact us to help modify it to meet the requirements of an "Intent to recommend" card.

Information about funding for nonprofits

Information about funding for nonprofits

Are you a 501(c)(3) registered nonprofit interested in applying for funding from the Philanthropic Impact Fund (PIF) or the Sustainable Disaster-Relief Fund (SDRF)? Grants are awarded annually via a competitive request for proposal process (RFP). The process varies between the PIF and SDRF. Click on the links below to read about eligibility criteria and how to apply for funding from Vanguard Charitable.

To submit an RFP or LOI, click on the applicable link below. You will be asked to create a profile for your organization and complete a funding application for this year’s funding.

Sustainable Disaster-Relief Fund request for proposal

Request for proposals: Open | December 1, 2025 – January 9, 2026

Review our SDRF Frequently Asked Questions for additional details.

Philanthropic Impact Fund request for proposal

Please note: In order to apply for funding from the PIF, you will need to complete a Letter of Interest (LOI), demonstrating that your request is aligned with one of the PIF's focus areas. If your LOI is approved, you will be invited to complete a full proposal.

Request for LOIs: CLOSED

If you're interested in submitting an LOI for our next granting cycle, please check back in Fall 2026 for more information.

I’m a donor who wants to find a charity to support.

If you are a donor looking for charities to support, visit our Recommend a grant page for more information. When you open an account, we provide free and unlimited access to the Candid charity directory to help you select and learn about charities. You may also want to visit candid.org, charitynavigator.org, or givewell.org.