Build a plan

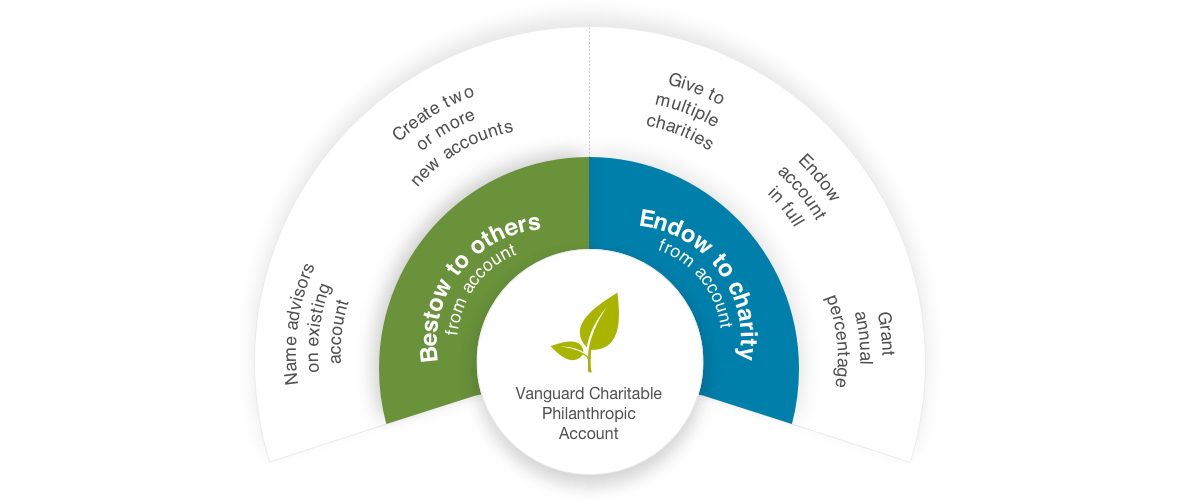

We offer a number of succession options that can be mixed, matched, and combined in almost any way to build a plan that meets your needs. Need help with your customized succession plan, let us know. We review plans on a case-by-case basis.

Succession plans

Succession plans begin when advisors are unable to manage the account. While Vanguard Charitable remains the account owner and invests and grants the assets, you can recommend to whom the account privileges are bequeathed. Once your plan is set, be sure to review it annually to ensure your plan remains aligned with your charitable goals.

If succession plans are not set, account assets will automatically transfer to the Philanthropic Impact Fund (PIF), which issues grants primarily to nonprofits that seek to improve philanthropy.

Bestow to others

Pass account privileges to others

Most often a spouse and children assume account privileges, but any individuals, up to two, can be named successor advisors. Once the plan is enacted, the advisors you choose can select investment options, change account preferences and recommend grants. They can also name new successor-advisors, potentially passing the account on for generations.

Create new accounts

The account can also be split into multiple new accounts, with each account allowing up to two successor-advisors. Each new account requires a minimum initial balance of $25,000.

Endow to charity

Recommend recurring grants

An Endowed Grant Plan schedules recurring grants for one or more charities based on a percentage of the remaining account assets. Total annual distribution must exceed 5% and can be distributed over time. During this time, the remaining account assets continue to grow tax-free through investments. See our Policies & Guidelines for more information.

Recommend final grants

This option allows you to recommend final grants to one or more charities to deplete the remaining account balance.

Transfer to PIF

Our Philanthropic Impact Fund (PIF) issues grants to nonprofits that seek to improve philanthropy in two ways: by developing and delivering resources to help donors make effective giving decisions and helping charitable organizations operate more efficiently.

Examples of legacy plans

The succession plan options are intentionally flexible. They can be changed or amended at any time. Talk to us about what you want from your legacy plan, and we are happy to offer suggestions.

One of the greatest benefits of a Vanguard Charitable legacy plan is choice. The two main options, bestow to others or endow to charity, offer flexibility that ensures your charitable vision carries on, in a way that fits your charitable vision.

You can pick one or the other, or assign percentages of each. For example, you may want to open two new accounts and then recommend recurring grants with the remaining assets. It's your choice.