How DAFs have reshaped philanthropy for the better

Oct 13, 2021

Rebecca Moffett

President

Back in 2019, Vanguard Charitable shattered its record for total grant dollars in one year, reaching over $1.3 billion in grants. Sometimes it’s easy to lose sight of what a number that large actually represents. It represented a whole lot of resources for hardworking nonprofits all across the country and world. It meant food for the hungry, healthcare for the ill, educational opportunities for our children, protection for the environment, support for cultural institutions, and so much more. The incredible granting total in 2019 underscored just how generous our donors are and left me wondering how they might build on such a remarkable year.

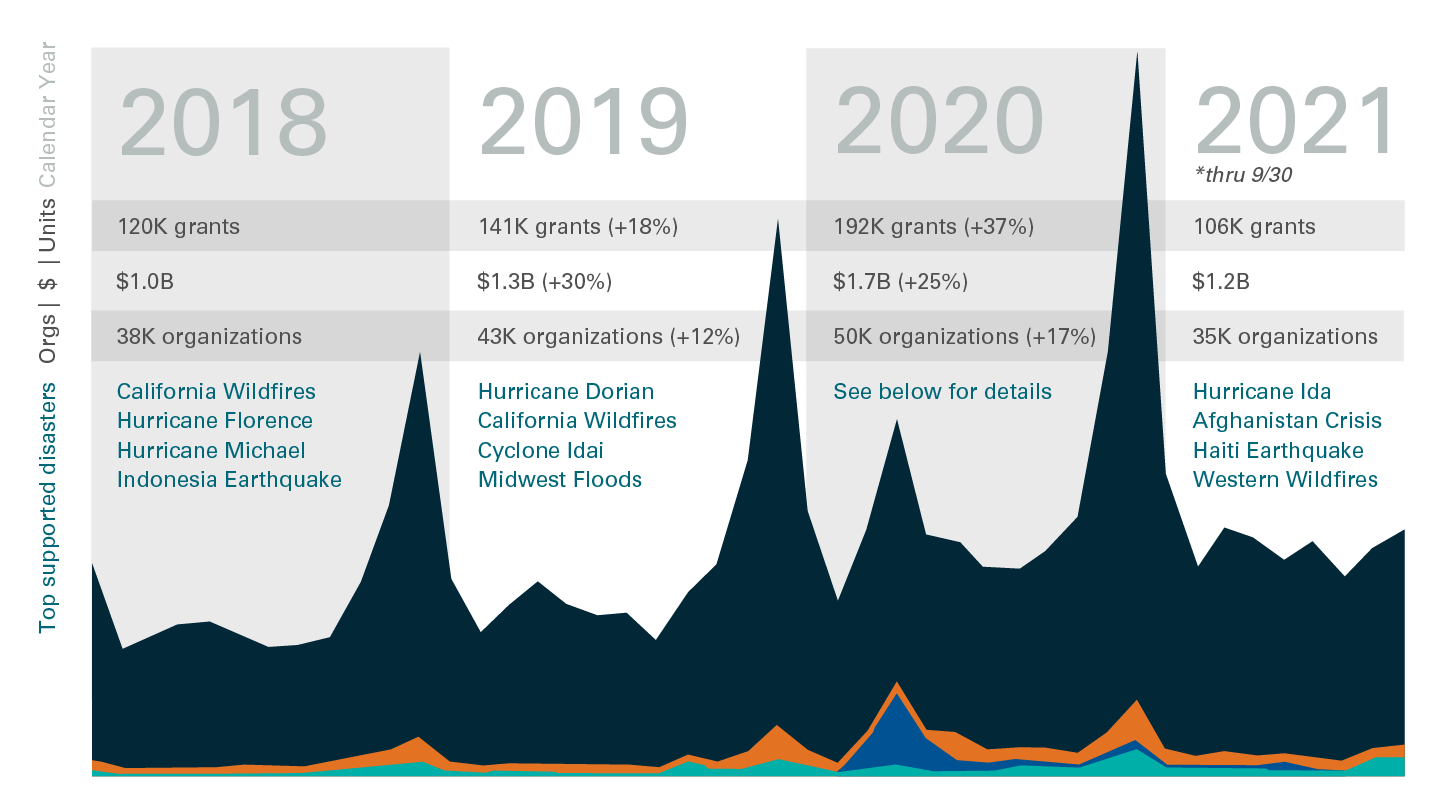

Then the COVID-19 pandemic struck early in 2020 and disrupted so much of our society as we knew it. Fortunately, Vanguard Charitable donors were again ready to rise to the occasion. When the dust had settled, we’d broken our 2019 record—by a sizeable margin. Granting last year exceeded $1.7 billion, a 25% increase from the unprecedented mark the year before.

This is the story of donor-advised funds (DAFs). In a normal year, they are strong charitable engines that churn out donations and help power the philanthropic sector. But when the unthinkable happens, they are also equipped with a special extra gear. In the past few years alone, we’ve seen our donors respond meaningfully in the wake of hurricanes in the U.S. and abroad, wildfires in Australia and the western U.S., an earthquake in Puerto Rico, a brutal winter storm in Texas, and an explosion in Beirut, just to name a few. No community is immune to crises of this sort, but it’s reassuring to me to know our donors will be there to help.

See how Vanguard Charitable donors have responded to various crises over the past three years.

But DAFs don’t just help respond to disasters. Evidence shows they can also be a stabilizing force to the philanthropic world during economic downturns.1 Because DAF advisors have already designated funds for charity, they can respond more easily than other sources of giving, which tend to dry up during recessions. It’s this upfront commitment to charity—not just to giving, but to long-term, sustainable support—that sets DAFs and their donors apart.

And once the charitable funds have been committed, we immediately set them to work. Our donors choose from Vanguard Charitable’s diversified lineup of high-quality, low-cost investment options, which have driven tremendous returns on charitable investments in recent years.2 One study concluded that DAFs created more than $5 billion in new charitable dollars from 2015-2019 due to their ability to grow charitable investments tax-free.3

It's this upfront commitment to charity—not just to giving, but to long-term, sustainable support—that sets DAFs and their donors apart.

From my conversations with donors, I know that they often grant much more than they initially intended or thought they would be able to, thanks to this same investment growth. It’s a model that offers the best of both worlds when it comes to supporting your favorite charities. You can continue to give on a regular basis while still having additional funds available for a larger gift, or a special project, or an unexpected event, like a hurricane or pandemic.

DAFs fill what had been a gap in the philanthropic landscape. The popularity of DAFs among donors and the positive impact DAFs have on nonprofits and their constituents speak to the importance of this giving tool. By prompting donors to think of their giving as an ongoing commitment, DAFs challenge us to be more generous, more creative, and more impactful. The entire charitable sector benefits as a result—both today and tomorrow.

1Heist, H. D., Vance-McMullen, D. Understanding donor-advised funds: How grants flow during recessions. https://www.sp2.upenn.edu/wp-content/uploads/2019/02/Heist-Vance-McMullen_Understanding-Donor-Advised-Funds_working-paper-002.pdf

2Past performance does not guarantee future returns.

3Husock, H. Appreciation in Donor-Advised Funds: An Analysis of Major Sponsors. American Enterprise Institute. https://www.aei.org/research-products/report/appreciation-in-donor-advised-funds-an-analysis-of-major-sponsors/