Survey Says: Here's the one thing nonprofits want most this holiday season

Nov 30, 2021

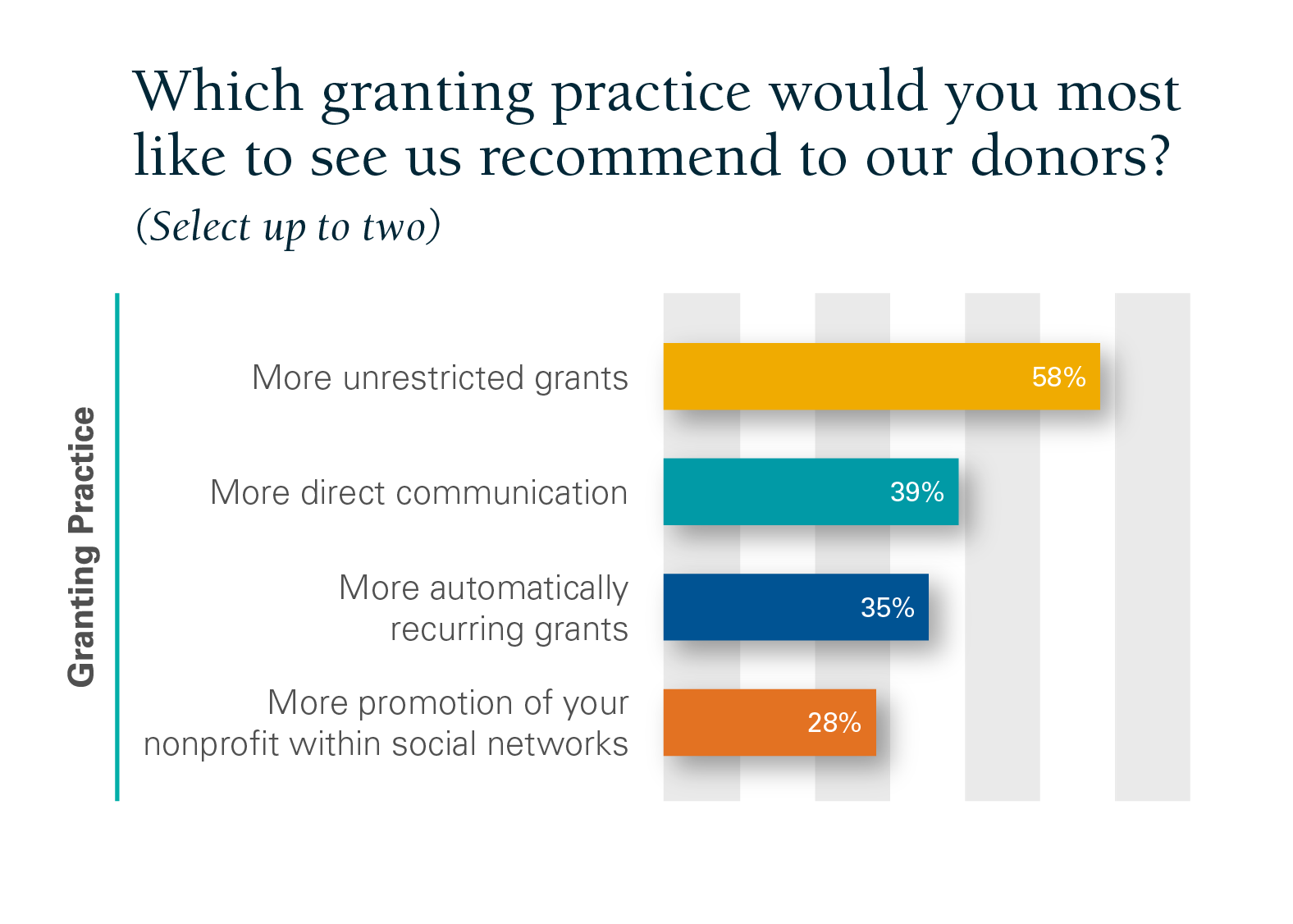

When we asked what request nonprofit organizations would make of our donors, nearly 6 in 10 had the same response: More unrestricted giving.1

Unrestricted giving—donations or grants that can be used for any purpose by the receiving charity—is considered the gold standard for charitable giving because it offers charities the ability to direct funds to their areas of greatest need.

|

Our recent survey of 440 of our nonprofit partners yielded insights for donors.

One healthcare charity explained how unrestricted donations have been crucial in helping the organization respond to the fast-moving COVID crisis: These gifts let the organization shift its focus immediately to training staff on the virus and developing new treatments, rather than having to do targeted fundraising first.

“Having dollars that are flexible in purpose [is] incredibly helpful in our ability to react to a new challenge or opportunity,” the organization said.

To restrict or not restrict?

Some donors make restricted gifts because they want their donation to translate directly to specific services provided by a nonprofit.

This is a powerful approach when done in close collaboration with a nonprofit. But charities may be wary of restricted giving if it is connected to misperceptions about “overhead.” Overhead is necessary in any organization. Investments in staff, physical infrastructure, and technology not only help nonprofits provide services, but also pay dividends in helping an organization grow and increase its effectiveness.

Unrestricted gifts also allow nonprofits to cover “expenses that can be difficult to fundraise for,” said an education charity. An international charity explained how varying levels of media attention can mean that a region or community in great need may not be on a donor’s radar. If the donor makes an unrestricted gift, however, then the charity can address these overlooked communities.

To make a grant unrestricted, recommend a grant from your Vanguard Charitable donor-advised fund account, then select “General operating expenses,” “Unrestricted gift,” or “Area of most need” from the Purpose of grant dropdown menu.

In their survey responses, many nonprofits were quick to explain that restricted grants are still greatly appreciated. They understand donors may have different goals for each gift and encourage donors to use all the giving options at their disposal. If you’d like to restrict a gift, a great first step is to reach out to the nonprofit to make sure your goals and the nonprofit’s priorities are aligned.

Still, it’s important to recognize that restricted giving can sometimes create more work for nonprofits. One human services organization explained that restricted gifts require the finance department to identify and track funds more rigorously. These additional responsibilities lead to higher costs for an organization and may reduce the value of a donor’s initial donation.

Nonprofits seek more opportunities to tell their stories

While more than half of nonprofits ranked “more unrestricted giving” at the top of their wish list, nearly 2 in 5 also requested more communication with donors. This isn’t surprising since we know nonprofits want more opportunities to share the work they do and the need they encounter among the populations they serve.

The good news is that 96% of Vanguard Charitable grants already include donor information and allow for donor stewardship. However, this holiday season, we challenge you to consider other ways you can engage with the nonprofits working so steadfastly on the causes you care about most.

Our survey of nonprofit organizations was conducted between October 4-19 by Vanguard Charitable, a leading provider of donor-advised funds and one of the top grantmakers in the U.S.1

1In the survey of 440 nonprofits who have received at least one grant from Vanguard Charitable over the past five years, responding charities were given a list of possible giving recommendations for donors and asked to choose up to two that were most important to them or suggest their own.