Save to give: How millennials will shape philanthropy

Nov 21, 2017

*This is the final installment in our save to give series. Read part one, “Planning for your philanthropy retirement.” Read part two, “Stretching your charitable dollars.”

Each generation approaches philanthropy differently. With millennials in particular receiving a lot of attention recently, as ascending generations often do, we wanted to use the final blog in this series to see what we can expect in the way of charitable giving from this group.

Research suggests that millennials are results-oriented. According to The 2015 Millennial Impact Report, millennials are more interested than their predecessors in seeing tangible evidence of the impact of their engagement. Millennials have not yet reached their maximum earning potential, and so their average giving lags behind that of other generations, but indicators like high volunteerism underscore millennials’ interest in making the world a better place.

The usage among millennials of donor-advised funds (DAFs) is growing at Vanguard Charitable. Our millennial donors give at a higher clip and are more likely to follow up with nonprofits to monitor the impact of their giving. These data points suggest that, as millennials become more financially secure, they will have a major impact on the philanthropic landscape of the future.

Our millennial donors give at a higher clip and are more likely to follow up with nonprofits to monitor the impact of their giving, suggesting that they will have a major impact on the future philanthropic landscape. |

For this reason, the save-to-give scenario this week considers a hypothetical millennial, a member of the generation that is most advantageously positioned to benefit from the long-term power of a DAF. In the two previous blogs, we looked at data from the past 20 years. This blog will forecast into the future, using this past data as a guide.

These are projected figures that assume returns similar to those we have seen in the past 20 years. The projections should not be taken as a firm prediction of future growth, but they do give a broader sense of the type of impact millennials can have.

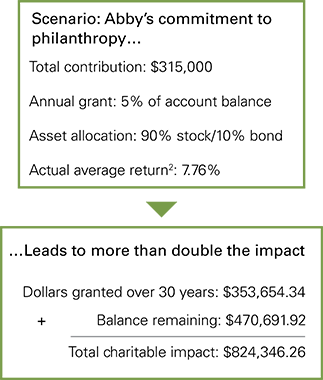

Imagine a 30-year-old named Abby. Let’s say she is a sharp businesswoman who has been involved with a series of successful start-ups. She is interested in a long-term giving strategy that will set her up to become a serious player in the philanthropic field later in life. She contributes $25,000 worth of IPO stock to open her DAF account, and then commits to an additional contribution of $10,000 each year afterward. She intends to grant 5% of her funds each year, leaving the majority of her account to grow tax-free over her desired 30-year timeframe.

Abby decides that an equity-heavy portfolio (90% stocks and 10% bonds) is right for her. This allocation will support her ambitious growth goals in the current low-return environment, and her extended time horizon can help her ride out any volatility that accompanies her stock-centric approach. Let’s see how she does.1

With her longer timeframe, Abby’s return on investment is even more impressive than in the previous examples we’ve explored. Her charitable impact is a whopping 162% greater than if she had made her contributions directly to charity.3 Note that this model assumes her rate-of-giving and granting will stay constant over the course of 30 years. In reality, Abby’s DAF account would give her the flexibility to adjust these aspects of her strategy to meet new giving goals.

While Abby might not be representative of all millennials, who may not yet see themselves as philanthropists, but Vanguard Charitable has more millennial donors than you might expect. With hundreds of new millennial accounts in the past few years, their share of the pie is growing. More broadly, millennials have recently surpassed Baby Boomers as the most populous generation. As they continue to come into their own, they will have the power to shape society and the philanthropic landscape.

The power of saving to give

Taken together, we hope the three scenarios in this series have highlighted the value of adopting a save-to-give approach to charitable giving. They show that our donors don’t need to choose between an immediate impact and a long-term outlook. They can have both. The variety of approaches taken by these hypothetical donors demonstrates how long-term plans can allow you to be creative and do more with your giving. As we move into our next 20 years, saving to give will help our donors continue to amplify their imprint on the world of philanthropy.

Want more save-to-give? Read the first and second blogs in this series.

1In this scenario, the following assumptions were made:

- All investments are subject to risk. Past performance does not guarantee future returns. Diversification does not ensure growth or protect against a loss in a declining market.

- All contributions are made as charitable donations to a philanthropic account held at Vanguard Charitable’s donor-advised fund. No startup costs are incurred, but accounts are charged an annual administrative fee based on balance: 0.60% for the first $500,000 and 0.40% for the remaining balance. Pricing will continue to decrease as account balance increases.

- All account assets are invested in a mix of underlying Vanguard® mutual funds, which assess an expense ratio. Expense ratios are assessed by the underlying funds and may vary based on account allocation and status; Vanguard Charitable does not itself charge investment fees.

- Many donors contribute to a DAF at year-end and then start recommending grants in the following year. To represent a standard accrual time in the scenarios, contributions are counted on January 1 and grants are issued on December 31 of the respective year.

- Invested assets are rebalanced monthly to match recommended allocations. The allocations in the paper are suggestions, and donors are encouraged to diversify their investment recommendations to take advantage of a broad range of investment options, including international and domestic and across major asset classes

2 Average return is calculated as a time-weighted return annualized over the 20-year period from 1997-2017. The scenario assumes the same rate of growth for the next 30 years.

3Net performance is based on actual returns of the Investor share class of Vanguard Total Stock Market Index and Vanguard Total Bond Market Index Funds from January 1997 through December 2016. Performance returns reflect market movement, reinvestment of dividends/interest and capital gains, and deduction of the underlying fund’s expenses. Vanguard Total Stock Market Index Fund benchmark: Spliced Total Stock Market Index reflects the performance of the Dow Jones U.S. Total Stock Market Index (formerly known as the Dow Jones Wilshire 5000 Index) through April 22, 2005; MSCI US Broad Market Index through June 2, 2013; and CRSP US Total Market Index thereafter.

Vanguard Total Bond Market Index Fund benchmark: Spliced Barclays U.S. Aggregate Float Adjusted Index reflects the performance of the Barclays U.S. Aggregate Bond Index through December 31, 2009, and Barclays U.S. Aggregate Float Adjusted Index thereafter.