Vanguard Charitable launches 3 new social investment options, expands investment lineup to 20 low-cost, diverse choices

Sep 27, 2018

Vanguard Charitable remains committed to providing you the tools and resources you need to achieve your short- and long-term philanthropic goals. To help you better align your charitable investment strategy with your giving plans, we are excited to announce several new investment options.

Beginning October 4, 2018, Vanguard Charitable will launch:

- ESG U.S. Stock

- ESG International Stock

- ESG Global Stock (a proprietary 70/30 blend of U.S. and international stocks)

- Total International Bond

- Balanced Index

- Wellington

- Income (a proprietary 20/80 blend of stocks and bonds)

Donors who are interested in socially and environmentally responsible companies will now have the choice to invest in three new options using environmental, social, and governance (ESG) screening criteria. Vanguard Charitable’s ESG options will invest in funds launched by The Vanguard Group, Inc., in mid-September.1

“Our donors are increasingly interested in aligning their charitable investment strategy with their personal values,” said Jane Greenfield, president of Vanguard Charitable. “We are thrilled to offer indexed Vanguard ESG ETFs that provide donors with access to the broader market through an ESG screen.”

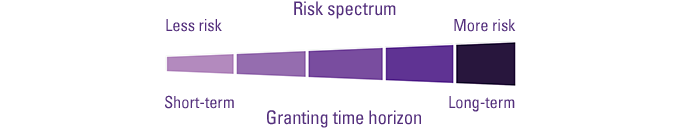

A look at Vanguard Charitable’s new risk and granting spectrum

In addition, donors can look forward to newly-redesigned investment pages, featuring risk and grant planning information, a high-level, comparative look at all investment options, and new groupings—Portfolio Solutions, Portfolio Builders, and Values-Driven Investments—as a way to guide donors at all levels of investment acumen to choose the best options for your philanthropic needs.

Portfolio SolutionsPre-allocated investments |

Portfolio BuildersIndividual funds |

Values-driven investmentsOptions that integrate |

“Our primary objective is to help our donors increase their impact on the causes and missions they care about most. By restructuring and expanding our investment options, we’re ensuring our donors have access to a diverse range of asset classes and professionally-rebalanced funds, all at a low cost, to construct the right charitable portfolio for their specific giving goals,” said Jane.

Donors will be able to recommend investment in the seven new options beginning October 4, 2018.

- Log in to post comments