How to give in a time of inflation

Aug 02, 2022

For the first time in 40 years, inflation is a major force in both American life and in the global economy. In June, consumer inflation in the United States rose at 9.1%, the highest rate since November 1981. The challenges brought about by inflation—such as higher prices for necessities like food and gasoline and rising interest rates for mortgages—are daunting in part because, after many decades of low inflation, they are new and unfamiliar. As a result, Americans are grappling with inflation’s widespread implications while trying to determine the best way to respond. This same uncertainty is especially pronounced in the charitable giving sector.

With many charities already struggling to maintain or increase services in the aftermath of the COVID-19 pandemic, the challenges of inflation have only made matters worse. Because inflation tends to exact its greatest consequences on individuals who have less to begin with—and the charities that serve them—it’s a critical time for those fortunate enough to have the means to give back to weigh their options. Below, we’ve put together five suggestions for impactful charitable giving at this volatile moment.

Give Unrestricted

Give Unrestricted

Inflation makes flexible giving an even more important cornerstone of one’s charitable strategy. A nonprofit facing surges in energy costs one month may find that fundraising costs have shot up the next. By giving unrestricted, you are not only equipping charities with the ability to contend with unexpected price increases, but are also practicing “trust-based philanthropy,” affirming that you believe the charity itself knows best how to serve its mission.

In a recent survey of our grantee recipients, nearly 6 in 10 said they would appreciate more unrestricted granting from donors with donor-advised funds. “Unrestricted funds allow for gap-filling in nonprofit organizations,” reported one international health charity. “Funds are spent where they are most needed.”

Revisit annual or recurring gifts

Revisit annual or recurring gifts

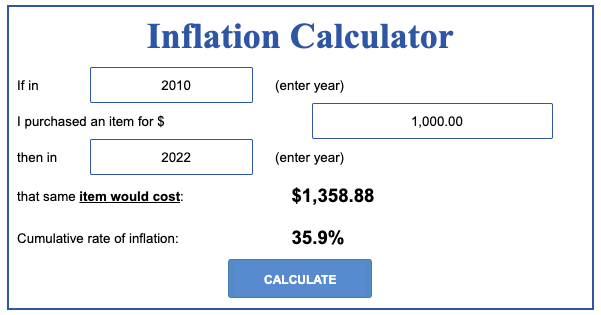

Let’s say you give a charity $1,000 every year as part of an annual tradition. Given current levels of inflation, the value of your donation this year could be notably less than in years past. As the charity faces higher costs or takes on more services, your donation may inadvertently give the charity less to work with.

The relative value of $1,000 annual gifts that began in 2010 |

| Year | Charitable Gift | Value in 2010 dollars | % Reduction |

| 2010 | $1000 | $1000 | -- |

| 2013 | $1000 | $936 | 6.4% |

| 2016 | $1000 | $908 | 9.2% |

| 2019 | $1000 | $853 | 14.7% |

| 2022 | $1000 | $736 | 26.4% |

Unlike businesses, charities generally can’t raise prices to help combat inflation. That leaves them stuck with either reducing services or reaching out to donors for more funds. But by adjusting the amount you write on your annual check, you can play a key role in helping charities withstand a period of higher costs. Donors with donor-advised funds (DAFs), meanwhile, can leverage the power of their DAFs’ tax-free investment growth to increase their grant recommendations or update their recurring grant schedules.

Tip: Use www.usinflationcalculator.com and enter the year you began giving to your favorite charity and the current year to find out how you can adjust your generosity for inflation.

| A $1,000 donation in 2010 is approximately equivalent to a donation of $1,359 today. |

Take the long view

Take the long view

While inflation may peak in the near future, we will likely be living in inflationary times for years to come. Savvy donors should consider the big picture and think about how best to offer ongoing support for the charities they care about most. “A one-time donation is always meaningful,” says Vanguard Charitable Chief Investment Officer Mark Froehlich. “The next step is putting yourself in a position to give repeatedly over time.”

In an inflationary environment, donor-advised funds excel as a giving tool.

In an inflationary environment, donor-advised funds excel as a giving tool. Donors can lean on DAFs’ power, convenience, and flexibility to increase the impact of their giving, granting more (and for a longer period of time) than they may have originally thought possible. From a nonprofit’s perspective, this means more sustained, reliable support, even in a difficult economy.

Target hunger and homelessness

Target hunger and homelessness

Two of the sectors that have seen the greatest recent price increases have been food and shelter. Food prices, for example, are up 10.4% from a year ago, outstripping the market-wide pace of inflation. “Most food banks say food purchase costs are up,” reports Laura Reiley at the Washington Post, “and they’re also paying more for transportation and distribution, while reporting labor shortages.”1

Shelter costs, meanwhile, are up 5.6% over the same period, putting additional pressure on individuals and families facing housing insecurity. And organizations working to feed and house Americans are facing yet another blow: Demand for their services is increasing at the same time their costs are rising.

Vanguard Charitable donors have a history of targeting hunger and homelessness as a top charitable priority. Last year, inspired by our donors’ feedback, we launched a new iteration of our Nonprofit Aid VisualizerTM, or NAVi, to help our donors pinpoint charities at work in areas across the country that are most vulnerable to hunger and homelessness.

NAVi for Hunger & Homelessness

When the need is great and persistent, the response must be innovative and ambitious.

Click the play button to see how NAVi empowers your giving.

Reach out to your favorite nonprofits

Reach out to your favorite nonprofits

Another common request from nonprofits? More direct communication with you. The workers at your favorite charities are the foremost experts in their missions, and they have great insight into today’s most urgent needs. If you do want to consider a restricted gift, for example, doing so in collaboration with your favorite charity is a best practice to make your donation as impactful as possible.

Keeping open lines of communication with your chosen charities shows how much you value the work they are doing. This sentiment can go a long way in a difficult labor market where nonprofit employees may feel stretched thin. Communicating with your favorite charity is often invigorating for you too, offering a deeper connection to the mission that inspired you in the first place.